Lump sum future value calculator

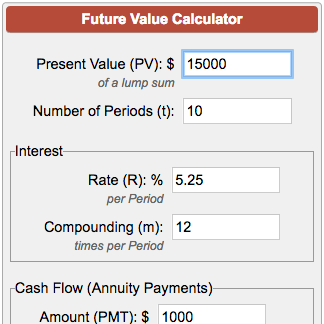

Leave the Payment PMT field empty or 0. The actual rate of return is largely dependent on the types of investments you select.

Future Value Factors Accountingcoach

For stock and mutual fund investments you should usually choose Annual.

. 1 month 1 day Future Value Lump Sum Future Value Calculator Definitions Initial deposit amount Amount of your initial deposit or account balance as of the present value date. This calculator allows you to choose the frequency that your investments interest or income is added to your account. Ad This timely report looks at market political economic factors and more.

The more frequently this occurs the sooner your accumulated earnings will generate additional earnings. Calculate the future value of a lump sum given the term interest rate and compounding interval. The initial deposit will be made on this date.

Day to calculate the future value. The online calculator will calculate the return generated ie 2895992 and the maturity amount ie. This calculator allows you to choose the frequency that your investments interest or income is added to your account.

The more frequently this occurs the sooner your accumulated earnings will generate additional earnings. The basic formula for future value using compound interest is as follows. Enter the compounding interest rate to be used.

Please note that the expected returns is just an estimation based on the figures entered and does not assure the values calculated. Lump Sum Future Value By changing any value in the following form fields calculated values are immediately provided for displayed output values. The Future Value of a Lump Sum Calculator helps you calculate the future value of a lump sum based on a fixed interest rate per period.

For stock and mutual fund investments you should usually choose Annual. To find out the future gains for investments that compound monthly such as savings accounts simply divide the interest. If you invest 1 lakh rupees for 60 years at 15 rate of interest then according to lumpsum calculator the future value of your investments will be mindboggling 438 cr.

Since 1970 the highest 12-month return was 61 June 1982 through June 1983. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. In other words the Lumpsum Calculator tells the future value of your investment made today at a certain rate of interest.

Actual returns might vary depending on the performance of the mutual fund. To find the future value of a present lump sum simply put that amount in the present value field. For stock and mutual fund investments you should usually choose Annual.

Have a 500k portfolio. This calculator allows you to choose the frequency that your investments interest or income is added to your account. Get the latest stock market outlook by Fisher Investments.

The rate of return for this investment or savings account. Ad Objective-Based Portfolio Construction is Key in Uncertain Times. From January 1 1970 to December 31 st 2021 the average annual compounded rate of return for the SP 500 including reinvestment of dividends was approximately 113 source.

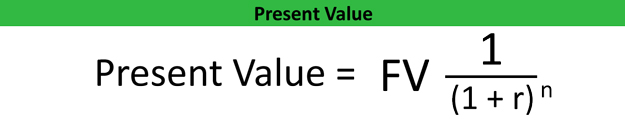

The more frequently this occurs the sooner your accumulated earnings will generate additional earnings. For stock and mutual fund investments you should usually choose Annual. FV Future value PV Present value i Interest rate t Number of periods.

Start date This is the starting date for your future value calculation. Learn How We Can Help. Do Your Investments Align with Your Goals.

From January 1 1970 to December 31 st 2021 the average annual compounded rate of return for the SP 500 including reinvestment of. Lump Sum Future Value By changing any value in the following form fields calculated values are immediately provided for displayed output values. Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients.

The basic formula for future value using compound interest is as follows. Set the number of periods to equal the number of compounding periods your interest or return will accrue. FV PV x 1 i t.

Enter the dollar amount of the lump sum of money you wish to calculate future value for without the dollar sign and commas. The more frequently this occurs the sooner your accumulated earnings will generate additional earnings. Find a Dedicated Financial Advisor Now.

The lowest 12-month return was -43 March 2008 to March 2009. Select either Months or Years and enter the corresponding number of periods. This calculator allows you to choose the frequency that your investments interest or income is added to your account.

The actual rate of return is largely dependent on the types of investments you select. Day to calculate the future value. The rate of return for this investment or savings account.

For example if your lump sum will grow for ten years at an annual rate type 10. In most cases the interest rate is annual. This calculator allows you to choose the frequency that your investments interest or income is added to your account.

The more frequently this occurs the sooner your accumulated earnings will generate additional earnings. For stock and mutual fund investments you should usually choose Annual.

How To Use The Excel Fv Function

Future Value Of An Investment Calculator Outlet 56 Off Www Ingeniovirtual Com

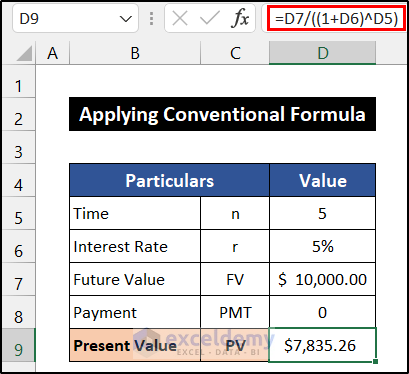

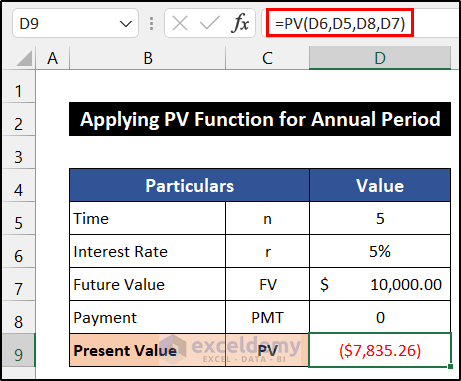

How To Calculate Present Value Of Lump Sum In Excel 3 Ways

Pv Calculator Deals 55 Off Www Wtashows Com

Present Value Formula Lump Sum Single Amount Formula With Examples Youtube

Present Value Of 1 Formula Best Sale 44 Off Avifauna Cz

Fv Function In Excel To Calculate Future Value

Lump Sum Shop 51 Off Www Ingeniovirtual Com

How To Calculate Present Value Of Lump Sum In Excel 3 Ways

How To Calculate Present Value Of Lump Sum In Excel 3 Ways

How To Calculate The Future Value Of A Lump Sum Investment Episode 38 Youtube

How To Use The Excel Fv Function

Future Value Of An Investment Calculator Factory Sale 53 Off Www Ingeniovirtual Com

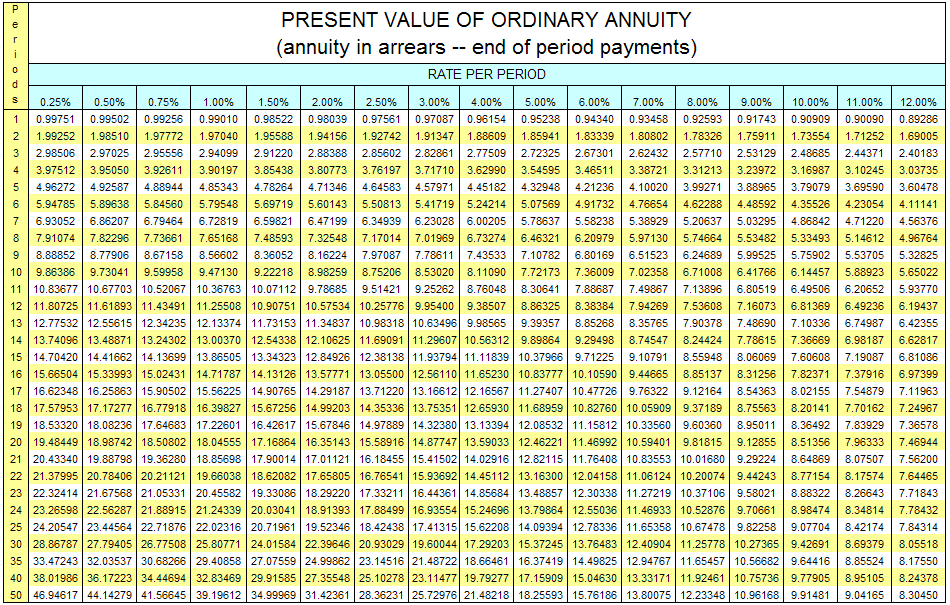

Present Value Formula Calculator Annuity Table Example

Lottery Winner S Dilemma Lump Sum Or Annuity

Present Value Calculator

Lump Sum Discount Rate Formula Double Entry Bookkeeping